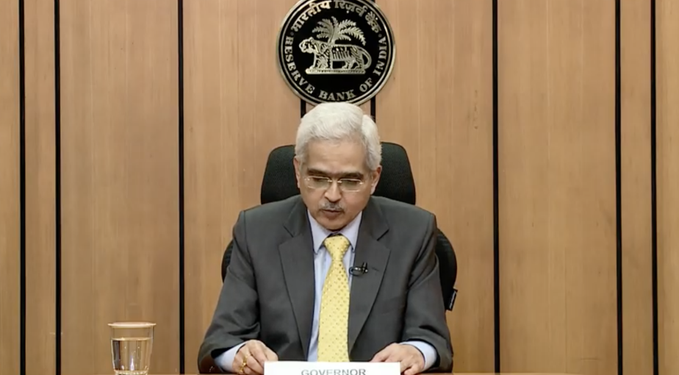

New Delhi : After a three-day meeting of the Monetary Policy Committee (MPC), RBI Governor Shaktikanta Das is now announcing the bi-monthly monetary policy in which repo rate was kept unchanged at 4%. RBI has already cut interest rates by 115 basis points this year, taking the repo rate down to 4%, the lowest since it was introduced in 2000.

RBI Governor : Live Updates

👉RBI is now announcing additional measures to enhance liquidity support, ease financial stress, improve flow of credit and deepen digital payment system.

👉Additional special liquidity will be provided to NABARD, National Housing Bank

👉Mutual funds have stabilised since the Franklin Templeton episode: RBI

👉Supply chain disruptions persist; inflation pressures evident across segments: RBI

👉Economic activity had started to recover, but surge in infection has forced imposition of lockdowns: RBI Governor Shaktikanta Das👉Real GDP growth is estimated to be negative for 2020-21.

👉Inflation remain elevated in the second quarter but it is likely to ease. Recovery in rural economy expected to be robust: Das

👉RBI has maintained an accommodative stance

👉Repo rate remains unchanged at 4%: RBI