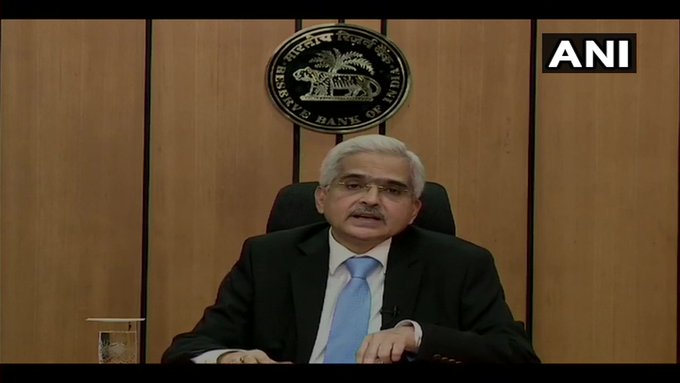

New Delhi : Today humanity is facing the trial of its time, as COVID19 grips the world with its deadly embrace. In this kind of environment Reserve Bank of India (RBI) has been very proactive & monitoring the situation closely : Says RBI Governer

👉It has been decided to provide special refinance facilities for an amount of Rs 50,000 crores to National Bank for Agriculture & Rural Development, Small Industries Development Bank of India, and National Housing Bank to enable them to meet sectoral credit needs: RBI Governor Shaktikant Das

👉It has been decided to reduce the fixed reverse repo rate under liquidity adjustment facility (LAF) by 25 basis points from 4% to 3.75%, with immediate effect:

👉Contraction in exports in March 2020 at 34.6%, turned out to be much more severe than during the Global Financial Crisis. However, amidst all this, the level of Forex Exchange Reserves which we have continue to be robust:

👉IMF Economic Counsellor has named it ‘The Great lockdown’ estimating cumulative loss to global GDP over 2020-21 at around 9 trillion US dollars, which is greater than the economies of Japan & Germany combined:

👉For 2020-21, International Monetary Fund projects sizable reshaped recoveries, close to 9 percentage points for the global GDP. India is expected to post a sharp turnaround & resume its pre-covid, pre-slowdown trajectory by growing at 7.4% in 2020-21:

👉Since March 27, the macroeconomic and financial landscape has deteriorated precipitously in some areas, but light still shines through.

👉On April 14, International Monetary Fund (IMF) released its global growth projections revealing that in 2020, the global economy is expected to plunge into the worst recession since ‘The Great Depression “.